How Blockchain Will Revolutionize the Securities Market

The blockchain concept, that underpins the bitcoin success story, has elicited a huge amount of interest in the capital markets. Stock markets across the globe are increasingly embracing blockchain’s inherent capabilities as the basis for their market transactions.

The Securities and Exchange Board of India and the Nasdaq are advancing the quest to implement the use of blockchain in the spheres of securities lending, fundraising, monitoring systematic risk, asset management, margin financing, repo and post-trade settlement. The major beneficiaries would be securities settlement and Asset documentation.

- The traditional centralized model for Securities market that exists today is time tested. For a long period of time, it has been relied upon to settle trades with strict regulatory infrastructure in place so that the safety of the trade being executed is guaranteed. This system, however, has suffered various limitations including the presence of multiple versions of truth that are maintained in siloed systems whose evolution over a number of decades complicated the systems further and usually calls for major reconciliations.

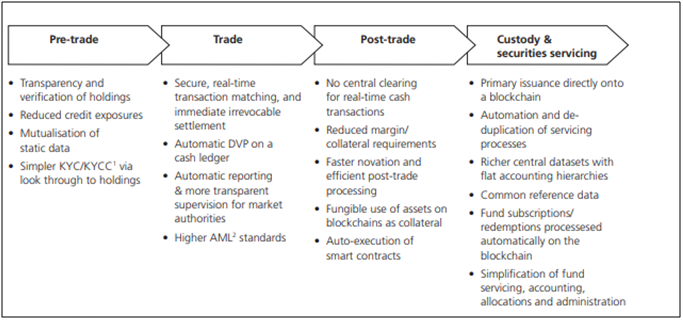

There are additionally complex procedures which include pre-trade, post-trade, custody and securities servicing; these are time-consuming, cumbersome, cost-inefficient and attract a high level of risk. For instance, stock market participants will need a minimum of 3 days to complete transactions.

These delays arise from the need to have intermediaries for processes such as operational trade clearance and regulatory processes among others which compound the delay in the entire process. According to global financial risk consultancy Oliver Wyman, operations and IT cost capital markets an average of $100 – 150billion every year with post-trade and securities servicing fees averaging at an additional $100 billion. The delays and inefficiencies in the market also have stock market participants incur significant capital and liquidity costs.

- It is with this understanding that many global exchanges and money regulators across the globe including the NYSE and Deutsche Borse are already showing intent to evaluate the advantages and feasibility of blockchain.

Potential benefits of blockchain for capital markets

What would the ideal picture look like?

If all things were at their best, the ‘utopia’ securities market would operate as follows;

Scenario 1; securities transaction

Client x and client y are matched on an execution venue on the blockchain. They automatically verify that they both have the capability to complete a transaction. They both sign the transaction through appending of their private keys so as to unlock their cash and asset for the transaction. They also use their public key to transfer ownership to the recipient. This transaction is broadcasted to the entire blockchain ledger to be validated and then recorded.

Scenario 2: Asset service

For new issues, the assets would be issued directly on the asset ledger. Better still the securities could be unbundled to enable for individual security cash flows and the rights they encapsulate could also be transferred individually.

- Smart contracts that are embedded in the securities could help manage mandatory events and distribution. Complex events could be broken down to simple delivery versus payment transactions between investors and issuers. Fund investors would be able to have a perfect view of pools of investment and would, therefore, better manage their investors’ holdings through the use of tokens on a fund hedge.

With flat accounting on the blockchain, the multiple custody layers can be collapsed into a single function. This is unlike currently where single security is held in numerous layers of custody with each having different accounting views. In a single function, the asset is held by a kind of wallet provider who records the final beneficial owner.

Scenario 3; Derivative transaction

Derivative transactions would undergo the biggest transformation. Unbundled securities would open up new approaches and opportunities for financial engineering. This would enable specialists construction of bespoke instruments with unique cash flows that would be personalized for individual credit risk needs as well as timing. Issuers could finance such instruments by selling their instruments which match the cash flows that they intend to achieve. This, in essence, implies that they would create swaps without having intermediation for their balance sheets.

Derivatives could additionally be created as pre-programmed smart contracts capturing the obligations of the two counterparties.

- A Central Counterparty Clearing House (CCP) would enable novating of a trade so that it allows dealers to net their exposures. Dealers would post their collateral to the CCP in form of the initial and variation margins which could be done escrowing cash on the ledger or by setting aside assets held on other asset ledgers for collateral.

Smart contracts could also enable for automatic re-computing of exposures through referencing agreed upon external data sources that recalculate variation margins. Derivative and collateral interoperable ledgers would automatically enable contracts to call additional collateral assets for additional needs from asset ledgers. And when mature, the smart contract would compute the final net obligation and consequently generate payment instruction on the cash ledger thus closing out the deal.

Implications of blockchain adoption on the market structure

Implementation of blockchain will change the roles of market participants.

• Clients

Clients on the buying side would be the major beneficiaries of the blockchain with reduction of prices. There is set to be an increase in trading volume among retailers and wholesalers particularly due to the guaranteed executions that would be on the open markets.

• Dealers

Dealers will be better placed to serve their clients as they will have better visibility within the blockchain to source for liquidity for assets, or in other instances take calculated principal risk where the liquidity is thin. Their differentiating factor would be in price setting, execution management and advising on transaction rather than specializing in market access.

• Private trading companies

The almost real-time settlement process would a determining factor for High-Frequency Traders (HFTs) and market makers. In markets where HFT is significant or markets that operate on a hybrid mode, the scope of blockchain would be limited to post-trade processes. This would enable HFTs to trade along credit lines which would regularly be cleared through the blockchain consensus cycle.

• Venues

The role of execution venues would remain almost the same; facilitating counterparties who wish to have a deal and enabling price discovery. Their value will, however, be enhanced by the cryptographic signature database formed at the time of transaction which is data required for settlement thus increasing the value of their roles. But given those trading strategies like HFT account for such huge shares of traded volumes, the profound changes on the market structure could have a knock-impact on other venues as well as exchanges.

• CCPs

Since there will be real-time asset transaction, there will be no need for a central body to cater for the transaction. However, for a transaction that bears longer life cycles, like in the case of derivatives, transactions would be in need of CCP novation for their netting benefits as well reduction of replacement risks.

• Custodians

Blockchains with distributed asset ledgers that have flat accounting structures would diminish the roles played by custodians and incorporate the ability to cross-sell other services. They may be limited to being the ‘keeper of keys’, information and ensuring servicing operations are done perfectly.

• CSDs

CSDs may have to oversee asset issuances and orderly functioning of the market; in principle, they will play the role of operational governance.

Challenges for adoption

There are six major challenges that still need focus to enable for a more efficient undertaking of blockchain in the securities market. They include the following;

- There is need to build scalability of the blockchain

- There is need to harmonize legislation and regulation

- There is still need for a robust cash ledger

- Lack of common standards and governance

- Need to be aware of the operational risk of transition

- How can blockchain manage the negative effects of anonymity

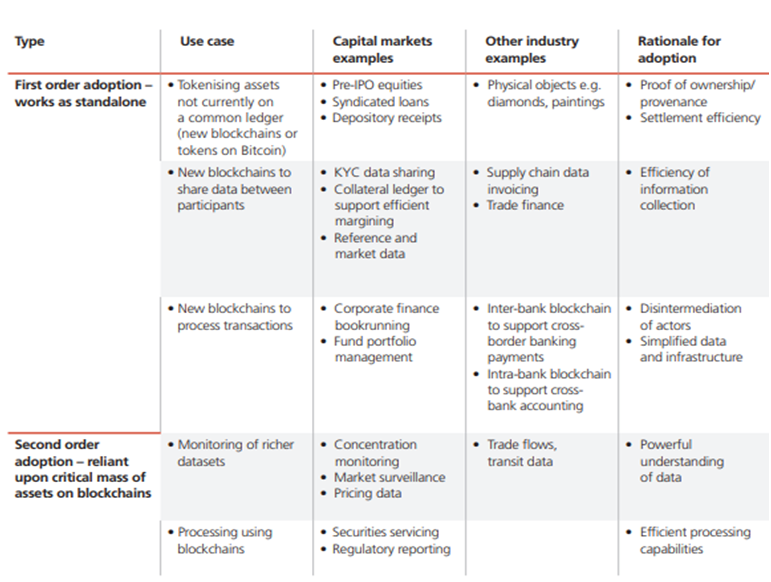

Where to start?

- Enterprise blockchain tokens will surely trend this year thanks to their improved liquidity and since they are based on smart contracts, they promise faster transactions and reduced administrative costs.

Conclusion

Blockchain potential to revolutionize the securities industry has never been more evident and that’s why the world of blockchain and securities exchanges is excited about incorporating blockchain into the securities exchange system. There are many entities that are already experimenting and implementing blockchain use cases already.

It is important that due diligence regarding blockchain’s compatibility with securities market is done so as to have a seamless transition. Companies could run blockchain and traditional securities system together and see how they complement each other.