Here’s how ICOs can revolutionize the Financial Industry

The global financial system handles trillions of dollars every day serving billions of people. But the system is characterized by additional costs in fees, delays, redundancy in paperwork that creates opportunities for fraud, and crime. 45% of financial institutions suffer yearly from economic crime. Regulatory costs have remained areas of concern for bankers. All these additional costs are ultimately passed on to consumers.

Fundraising through venture capital is no joke; normally entrepreneurs need to put together decks, be with partners in countless meetings, and undertake lengthy negotiations over valuations and equity in the hope of attaining an agreeable exchange of a size of the company for some funds. On the other hand, financial advisers/investment brokers are feeling the effects as financial product fees have been steadily decreasing for the last decade or so. This is highlighted by a recent Wall Street Journal article, which claims that since the year 2000, the average annual mutual-fund fee has fallen by more than one third. For funds that track a stock index, the average fee is now less than 0.1%. The result is that all these contribute to a somewhat complex financial system. Enter initial coin offerings (ICOs).

Introducing ICOs

ICOs are revolutionizing how start-ups/businesses raise funds. Statistics already indicate that the market has shifted in favor of ICOs. A quick preview of the last half of 2016 and the whole of 2017 reveal an explosion of the ICO market. ICOs raised $327 million during the first half of 2017 while VC funding accounted for only $295 million during the same period in that the amounts of money raised in 2017 by ICOs was 6% more than that raised by IPO. The 1.3 billion ICO funding realized in the Q3’17 was close to the total funding of all seed deals and tech angels in the same periods ($1.4 billion). By the first quarter of 2018, ICO funding was way above the total sum of ICO funding in 2017.

- With ICOs, anyone can raise money at any time from anyone; investors are at liberty to invest in projects that they find interesting. ICOs occur globally and are present online; businesses are no longer limited to the high-net-worth investors and government protocols, numerous investors with small amounts invest to raise all the needed funds.

ICOs promise investors immediate liquidity. Normally in the current financial system, it can take 10 years for equity to become liquid in case of an exit. But a token has a price immediately upon its sale. Consequently, institutional investor interest in the cryptocurrency market has been on the rise especially the venture capital sector which has taken note of the revolutionary impact of ICOs on particularly the financial industry and this has seen stakeholders start investing in ICOs. Firms like Sequoia, Union Square Ventures and Andreessen Horowitz, are investing directly in ICOs and cryptocurrency hedge funds.

Dan Morehead, CEO of Pantera Capital Management says this about the crypto market-

- “There’s such an institutional appetite to get exposure to this. It’s a half a trillion-dollar asset class that nobody owns…A wall of institutional money will drive the markets much higher.”

In April 2018, David Pakman, a Venrock partner, disclosed the firm’s deal with Brooklyn-based CoinFund. He stated that Venrock is looking to diversify its financial portfolio and that “rapidly growing blockchain sector will be a good bet.”

On the same note, studies show that 17% of 119 surveyed global hedge fund managers currently, or plan to invest in cryptocurrency while another study by Morgan Stanley shows that in 2017, hedge funds invested more than $2 billion in crypto-related assets.

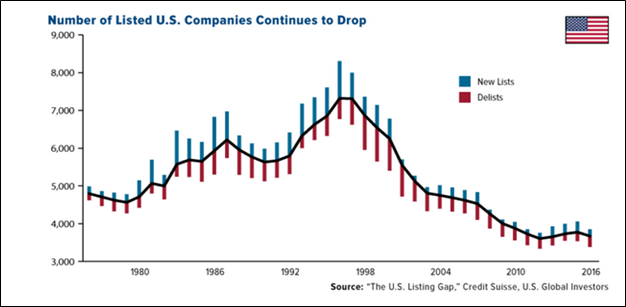

While the ICO boom is underway, we are witnessing a broader decline for IPOs in the market (7,322 in 1996 to 3,671 in 2017). Total funds from IPOs dropped in 2016 to as low as $18 billion compared to $74.4 billion raised in 2014.

https://www.cnbc.com/2017/10/25/where-have-all-the-public-companies-gone.html

Talking about fees paid to intermediaries like banks, ICOs provide trust without the need for intermediaries thus eliminating the fees paid to intermediaries.

The fees paid to investment bankers per each IPO range between 3.5% to 7%.

ICO; an efficient investment model

- One of the pains in the neck for the traditional model of fundraising is the inability of an investor to withdraw easily. Once an investor has signed and deposited their investment, there is hardly any reverse gear to recoup their funds outside of an IPO or an acquisition. This has the potential effect of notching a sizable loss in investor’s VC portfolios.

ICO injects more flexibility into investment models; investors have a variety of investment models to choose from. For instance, with ICOs, investors can choose between a standard equity that is similar to the traditional ones signed with startups or choose a Simple Agreement for Future Tokens (SAFT). SAFT offers several benefits to investors; companies are at liberty to fund projects that are in their pre-ICO stages and cash out when the product has launched a fixed number of tokens. The tokens are not equity and therefore give the companies greater freedom as well. This provides VCs with more incentive to invest directly in underlying technology because it has a higher likelihood of succeeding.

As mentioned earlier, the crypto market offers greater liquidity so that profits can be realized much faster with a blockchain-based investment company. And since investors will be dealing with tokens instead of shares, they have the ease of un-loading in the event their investment fails to perform. This would additionally mean that VCs are protected from drops arising from volatility and valuations. Presently, tokens and crypto-currencies experience massive shifts in their prices; an experience that VCs are unwilling to absorb into their funds. Finding an option that allows VCs to cash out before an impeding downturn enriches the VC investment experience by bolstering a profitable experience.

It is no secret that ICO has seen a mercurial rise in popularity. It is, however, important to note that volatility carries with it an element of opportunity for the VCs. For instance, whereas VCs experienced an average 8.7% return on their hedge funds, crypto-based funds experienced a 3,000% rate of returns. VCs have sought to cash in on the crypto-currencies’ enormous profit margin with 2017 alone recording investments of $1 billion from VC.

Looking Ahead

The blockchain is slowly but surely going to ingrain itself deeper as a disruptive technology going forward and provide opportunities for VC and ICO to coexist. Additionally, the crypto space is already laying the foundations that have seen broader adoption of ICO. This will give VCs greater incentives to further explore the sector, create hybrid funding models that would be much richer than simple ICOs. Major projects towards this end-like the Alphabet and Sequoia - are already in the tunnel. These hybrid models of interconnected blockchain and banking layers offer diverse services at reduced transaction costs and less risk.

- The enhancement of market and regulatory frameworks will see a more earnest advance of the hybridized financial services. This will enable digital asset exchanges, ICO projects and investment funds to better plug into traditional financial networks and help open the door for new dynamic financial services. It is, therefore, true that ICOs are already disrupting the financial space.

Here at ICOSERVICE we offer a whole new suite of marketing services which will help our clients differentiate their businesses and take advantage of the opportunities in this new model of fund-raising. ICOSERVICE’s comprehensive marketing methodology helps companies and start-ups get started on the right foot with their initial coin offering initiatives as they embark on this journey.

ICOSERVICE comprises of experts with varying skills from technologists, to digital marketers, to legal players, to blockchain enthusiasts and therefore partnering with ICOSERVICE not only helps you with the marketing side of conducting a proper ICO but also evaluating and implementing blockchain technologies in your business domains and deliver real value.