Why Security Token Offerings Will Be the Future Of Raising Money

The world over has witnessed the ICO revolution, but its downward trend has left many thinking the boom might as well be over! This could be due to the decrease in value of most crypto-currencies and lack of proper regulations.

Could this usher in the world of Security Token offerings?

Recently, Node Blockchain Inc. found out that Security Token Offering could as well be the future of fundraising for the blockchain industry. The truth is, while ICOs have helped raise significant amounts of money, its reputation has been dented with various scams in which investors have lost huge amounts of money to abandoned encryption projects. Studies indicate that of the 913 projects that had token-sales, only 48% were successful while 14% didn’t survive this stage. The rest, that is, 38% stayed unreported, with no data displayed. Some even had their websites and all traces of them disappear.

- As a result, regulatory bodies have had to put more efforts into combating non-compliant and fraudulent ICOs. STOs would, therefore, be the way to go in not only raising funds but also in securing the space against fraudsters; a critical element that is envisioned to net-in more investors.

Regulators consider the majority of the tokens offered during ICOs as actually being securities which must be subjected to regulation. The Securities and Exchange Commission (SEC) of the US argues that “most ICO tokens, in fact, qualify as securities. As a result, companies that issued them are breaking the law by offering unregistered securities.”

To determine whether an ICO qualifies as security, a Howey test is used which states that an investment contract is "a contract, transaction or scheme whereby a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party." In such a case, ICOs would definitely be considered as securities already.

- This shift has presented crypto lawyers and advocates with an opportunity for offering SEC compliant ICOs; the Security Token Offering. STOs are not only classified as securities, but they also offer the potential of being legally compliant ICOs by allowing companies to have existing securities like bonds on a blockchain.

In essence, STOs bring together the benefits of a regulated security market and merges with the benefits offered by the blockchain including the elimination of middlemen. Several start-ups and companies are already excited about this opportunity and are already advertising plans for a launch of their STOs in 2019. The Swiss Stock Exchange is building an exclusive platform for issuing and trading of STOs as they anticipate a boom in 2019. Yahoo finance agrees with this thinking; that 2019 could just be the year for STOs.

Defining STO

STOs are pretty much financial securities which are backed by a tangible value like assets, profits or revenues. They also offer legal rights like revenue distribution and voting. It functions the same as traditional security only that it is based on blockchain through which it is able to confirm ownership making fractional ownership possible. They are subject to federal regulations which govern securities and protect investors to a given level. And since STOs are tokenized on the blockchain, they are programmable and can make use of smart contracts to initiate particular ends without the need for third-party interventions like banks and advocates among others.

Potential benefits of security token offerings

Here’s a look at some of the benefits of STOs.

- Cost-effective

STOs are a cost-effective way of buying and selling security tokens. They attract zero administrative costs in buying and selling which go a long way in improving returns on investments.

- Faster operations

Thanks to automation, AML checks and Know Your Customer regulations, the process of selling STOs to accredited investors tends to be much faster.

- Global trading market

Since STOs are eligible for trading on the global scene, they are bound to attract greater liquidity. STOs’ acceptance to be used as financial instruments together with increased adoption will help bolster its liquidity levels.

- 24/7 trading

STOs can be traded 24/7 thus providing round the clock access to capital and liquidity on a global scale. This makes it more desirable compared to traditional securities that operate on fixed timelines. STOs can bridge the gap of accessing foreign capital which was largely a preserve of established businesses.

- Fractional ownership

Fractional ownership is attractive to secondary market investors and has the potential of enhancing democratization. STOs have improved efficiency in the way businesses raise capital. Underlying assets for security tokens can be subdivided into smaller units making them affordable to investors as well as making easy the process of transferability to the secondary market.

Shortcomings

The increased regulatory framework and limitations on the persons who can invest in STOs are major factors that could stifle the adoption of STOs on large scale and would, therefore, impact to a greater extent the liquidity of STOs. Additionally,

Remember to check the following before going for STOs

- ❖ Do proper asset identification and evaluation of the asset

- ❖ Consider corporate structure and governance since the issuance of STOs will need to be authorized by the issuer’s corporate documents; more so if they represent traditional equity.

- ❖ Select a choice platform for your STO

- ❖ Select credible and good service providers

- ❖ Consider compliance with KYC and AML regulations

- ❖ Be sure to get all legal and regulatory clearances

- ❖ Banking; there are not so many crypto-friendly banks globally. These few banks have a great degree of caution and discretion when registering new clients which could be much tighter for individuals from high-risk jurisdictions

- ❖ Have a sound tax planning strategy

- ❖ Have a prospectus

- ❖ Have a sound marketing strategy

STO regulatory space

- Anyone who wants to issue an STO will have to register with SEC. This procedure, however, is expensive and complex, a process that favours established businesses. To begin with, since the regulatory bodies are keen on protecting investors, STOs are offered to qualified investors.

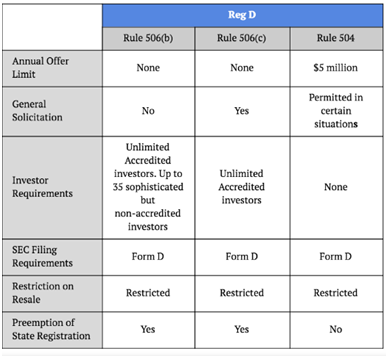

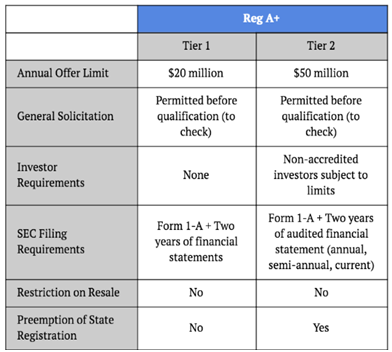

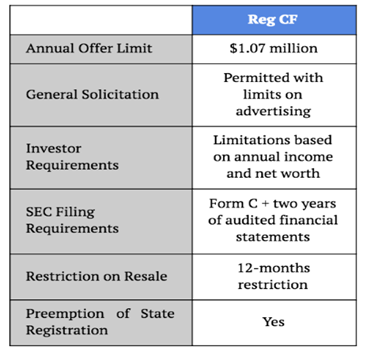

While the full securities regulations could be demanding and complex, the Jumpstart Our Business Startup Act (JOB) 2012 offers flexibility as well as exemptions for STO small startups. These rules were particularly set up with the view of helping small business raise their capital; this could provide token issuers with a working solution. In fact, Villenave urges ICO promoters to launch their ICOs as explicit STO. STO issuers in the US could make use of Reg S (rule 901-905), Reg D(rule 503, 504, 506), Reg A+, and Reg CF.

For instance, the full STO regulations defines an accredited investor as one who has net worth of at least $1,000,000 (without including the value of the individual’s primary residence) or have an annual income of at least $200,000 for the last two years and have the expectation of making the same amount in the coming year. But with the Jumpstart Our Business Startup Act, STOs below $5 million that are registered with state regulatory bodies do not have any restrictions on investor status.

- These means that STOs that are not registered and have no capital needs are open only to accredited investors. JOB provides opportunities for fundraising from $1 million to $50 million, elimination of restrictions in some cases and it covers provisions on secondary market safe harbour among others.

Conclusion

STOs will undoubtedly be the future of raising money especially as more progress is being made to merge the crypto and regulatory worlds. This will open up more opportunities for investors and issuers. And even with the new regulations, STOs can operate within JOB provisions thus facilitating safer and faster access to capital.

Are you planning a security token offering (STO)?

Here at ICOSERVICE we offer a whole new suite of marketing services which will help our clients differentiate their businesses and take advantage of the opportunities in this new model of fund-raising. ICOSERVICE’s comprehensive marketing methodology helps companies and start-ups get started on the right foot with their security token offering initiatives as they embark on this journey. ICOSERVICE comprises of experts with varying skills from technologists, to digital marketers, to legal players, to blockchain enthusiasts and therefore partnering with ICOSERVICE not only helps you with the marketing side of conducting a proper STO but also evaluating and implementing blockchain technologies in your business domains and deliver real value.