A New Look At The State Of The ICO Market

Is the ICO market dead? Well, if recent statistics and happenings have anything to teach us is that this could be the case.

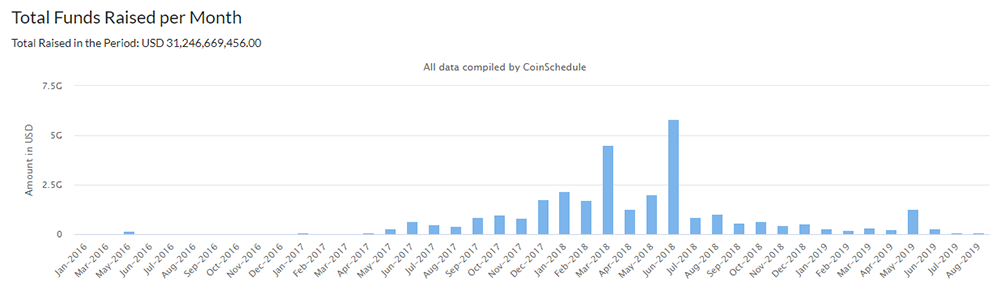

According to icodata.io, $346 million has so far been raised in 2019 from 83 crypto fundraising events, $7.8 billion was raised in 2018 from a total of 1,253 projects while 2017 saw 853 projects collect over $6.2 billion from token sales. On a similar note, Libra’s founding 28 members including Visa, PayPal, and Uber among others have found the ICO ground shaky and haven’t remained as steadfast given the eminent harsh glare of the regulatory spotlight.

The figures do not lie, 2019 has seen a major downfall of ICOs, but does this mean that the ICO market is dead? This article takes a level look at ICOs and the state of the ICO market.

Source: coin schedule

The state of the ICO market

To begin with, the end of 2017 and the beginning of 2018 saw the tipping point of the ICO market. ICO as a fundraising method was still novel and given that it was promising, everyone wanted to reap in early. The ICO model of investing small amounts into projects that promised high returns was lucrative and attractive to middle-income individuals and all other stakeholders in the crypto-currency world.

- There are many ways of determining the state of the ICO market. Let’s take a look at the different theories that could explain the state of the ICO market.

Market cycles theory; rise, peak, dip and bottom

To start with, let’s approach this evaluation using the four phases of a market cycle. We have all come across market bubbles and so many of us could know someone who has been caught up in one. And although there are plenty of lessons that investors could learn with each bubble, investors often get caught up each time another bubble comes up. It is important to understand that a bubble is only one out of the several phases in a market cycle.

According to investopedia, “no matter what market you are referring to, all go through the same phases and are cyclical. They rise, peak, dip and then bottom out. And when one cycle is done, the next one starts.” The problem is that most investors do not remember that there will be an end to every phase. Understanding the cycles is critical to maximize returns. During the rise phase, early adopters reap heavy returns from scoop discounts. The market moves to the peak phase where returns for early adopters are at their peak.

The market at this point is leveling out; the majority is jumping in while the smart money is cashing out. The market then starts on a distribution to mark-down phase. The sentiments here become mixed and slightly bearish, the prices turn choppy and sellers seek to prevail, the end of the season is almost near. In the down-ward phase laggards are now trying to sell to salvage what can be salvaged while the early adopters are at this time looking for signs of a bottom so that they prepare to come just before the rise begins again.

What investors and project leaders should do?

A look at the graph above reveals that the ICO market has gone through the four phases fully; from this perspective, the market could be ready for another rise, peak, dip and then bottom out.

These cycles present both pains and opportunities; with every dark cloud, there is a silver lining. A diligent look, analysis, research and evaluation will be critical at this stage.

As mentioned above, smart investors and project leaders should now be looking for indications to confirm whether ICO is at the bottom level so that they prepare to get into the market as early adopters just before the market begins to rise again.

- Preparation for investors would include being thorough with statistics and not relying on figures that are easily found on popular websites because they present the challenge of bias among others.

For project leaders, it is time to come up with great utility ideas and go further to make water tight business plans for guaranteed implementation for greater profitability.

The ICO evolution theory

Evaluating ICOs on the basis of being a means of raising capital gives us another perspective to the state of the ICO market. That ICO is undergoing an evolution into other forms of ICO in a bid to adapt to the changing market conditions. For instance, ICO is evolving into STOs to help meet the changing security and regulatory environment in the market while evolution into IEO is to help deal with credibility.

- An objective assessment would reveal that ICO was a great tool, still convenient for all stakeholders, helping even small investors access investment opportunities that would never have come their way. If ICO is just evolving into other forms that fit the needs and challenges in the crypto-world, then it would be safe to say that ICO still has a life in the market.

What investors and project leaders should do

Every phase of evolution presents new opportunities and new challenges. This calls for understanding of each phase and diligence on the part of both the investor and project leaders. There is need to maximize on the opportunities that were in the last phase of evolution so that you carry them into the new phase.

Additionally, look for the pain points both in the past and present phase and work around them to bring out a great investor experience. Take for instance the said ICO evolution into STOs; while STO meets the security and regulatory risk, it presents very high market entry requirements that lock out the small to medium investors.

ICO major downfall theory

ICO has had a major downfall; from $6 billion to $346 million in similar comparison periods. We fall to rise again. The first step to rising is to accept the fall, look back, learn lessons and change strategy. Here are points to consider that could have caused the down fall.

1. Clean the scams; build integrity, transparency

By March 2019, analysts started sounding the alarm that more than 80% of the ICOs were nothing but scams wrapped in blockchain mystery. Well, there is a great possibility not all were scams, but it is the one rotten apple that spoils the whole barrel! Investors need to be diligent with their research and statistics, and not lazily rely on any figure they come across; this will help them separate a scam from a true business and therefore cushion them from losing their money to scams. Thankfully the industry can self-regulate through the use of smart contracts and escrows.

2. Invest in Sound business planning

A number of the ICO projects did not have strong business plans and clarity of vision; they had colorful white papers. The ideas were great, promising but without a keen plan on implementation, measurement, reviewing and strategy even the best of the best was bound to fail.

3. Security and regulation

It is true that regulations, particularly from SEC, have weighed in heavily on ICOs. An acknowledged barrier to positive progress is clearly lawmaker education; most lawmakers are not opposed to ICOs, they are just unfamiliar with it.

Here is a quote from Congressman Warren Davidson while seeking inputs from the crypto-industry.

- “Your input is critical to helping us preempt a heavy-handed regulatory approach that could stall innovation and kill the U.S. ICO market,…With a thoughtful, bipartisan approach that protects consumers, advances free-market solutions and defines safe-harbors for the early stage innovators, Congress can send a powerful message around the world that the U.S. is the best destination for ICO markets.”

4. ICO data challenges.

There is the challenge of subjective matrices that are used for data collection and inclusion. And while blockchain data is immutable, the quality of data may be interfered with by scams; the interpretation and use of this data are prone to manipulation, and misinterpretation to fit desired ends.

According to Tim Glaus, Alethena Co-founder and COO

- "Anyone interested in either launching an ICO or investing in one will bear witness to a wholly corrupted market; telegram groups with fake and bought group members, numerous fake YouTube profiles offering review services, illegal email data lists, listing websites with fake traffic and, among many others, so-called ICO rating websites behind whose seemingly serious facades lurk a murky network of deceit and corruption.”

But the big question still remains- is the ICO market really dead?

No, it’s not dead but just evolving. While STOs and IEOs have brought in fresh ideas to the table, ICO has not yet found its replacement as a means of fundraising for the crypto world. ICOs that offer true utility in their tokens have succeeded and will be the ones to gain traction and succeed going forward.

Thankfully, recent happenings have seen collaborations between government bodies and the crypto-currency stakeholders to ensure a more level ground is found for the crypto world and ICOs. For instance, Congressman Warren Davidson intends to introduce new crypto legislation to congress. When asking for input from crypto stakeholders, he is quoted as saying:

- “Your input is critical to helping us preempt a heavy-handed regulatory approach that could stall innovation and kill the U.S. ICO market. With a thoughtful, bipartisan approach that protects consumers, advances free-market solutions and defines safe-harbors for the early stage innovators, Congress can send a powerful message around the world that the U.S. is the best destination for ICO markets.”

Major regulatory efforts are brewing to revive the ICO market in the US and bolster this innovation among others, in this regard, there is hope for the industry.

ICOs will need a more concrete business plan, and a clearer vision on how to fundraise more transparently; ICOs have a real long term chance of success. Additionally, there is a need for regulation in the ICO space so that one does not get millions of dollar funding at the very beginning of their project and ends up wondering if there is any need to go to the conclusive end of the project.

- Thankfully, the ICO space can self-regulate so that it is more secure, transparent and less risky. The industry’s use of smart contracts and Escrow-like services that could give investors the autonomy on when to join and when to withdraw could be options that would see the industry back on its feet.

Last but not least, if there will be any significant change, it will have to start with you; an ICO enthusiast, an investor, a third party or any other stakeholder. Be keen to do due diligence and not just rely on any statistics, invest in what is truly high quality and credible. Relying on regulatory agencies may not offer the best solution for the industry; the solution must come from within.

Are you planning an Initial Coin Offering (ICO)?

Here at ICOSERVICE we offer a whole new suite of marketing services which will help our clients differentiate their businesses and take advantage of the opportunities in this new model of fund-raising. ICOSERVICE’s comprehensive marketing methodology helps companies and start-ups get started on the right foot with their Initial Coin Offering initiatives as they embark on this journey.

ICOSERVICE comprises of experts with varying skills from technologists, to digital marketers, to legal players, to blockchain enthusiasts and therefore partnering with ICOSERVICE not only helps you with the marketing side of conducting a proper ICO but also evaluating and implementing blockchain technologies in your business domains and deliver real value.